Previous exhibitions

-

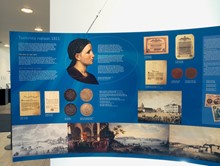

COUNTERFEIT MONEY!

“Feel, look, tilt”. With these wellknown instructions, you can distinguish between genuine and counterfeit euro banknotes.

Counterfeiting banknotes is an old and widespread crime. Harsh penalties and banknote security features have been employed in an effort to prevent counterfeiting. In this exhibition, we tell the history of Finnish banknote counterfeits and the measures taken to combat counterfeiting during the euro period.

You can also help in tracking counterfeits!

-

-

Bank of Finland 1918

This seasonal exhibition at the Bank of Finland Museum tells of the Bank's activities during the Civil War. It also recounts how the war affected Finland's monetary economy and payment mechanisms.

-

How will Finland make a living in 2067?

What will Finland be like in 2067? How will it earn a living? What will be valuable? What will Finnishness mean after 50 years? The exhibition present these perspectives through different forms of art. The young artists have created their own visions of the Finland of the future. Welcome to 2067!

-

The Great Depression

What depression? The Great Depression was an economic crisis that began in the United States and peaked in the 1930s, also undermining society and the economy in Europe and Finland. Bank crises, deflation and bankruptcies became commonplace everywhere.

-

Portrait of a nation - 150 years of statistics in Finland

Statistics set the basis for the development of a rational economic policy and society. Statistics Finland celebrated its 150th anniversary in October 2015.

-

Our mutual debt – Finnish Government borrowing 1859–2015

The history of Finnish government borrowing dates back to the 1800s.The government has raised loans to finance infrastructure investments, bolster the Bank of Finland’s foreign reserves and increase the room for fiscal policy manoeuvre.

-

IMF's 70th anniversary

The International Monetary Fund (IMF) is an international organisation that works to foster global financial stability. The IMF is the premier worldwide forum for economic cooperation.

-

-

Economic books that changed the world

The Bank of Finland Library is the leading specialist library in the field of monetary policy and finance in Finland. It serves the Bank’s own experts but also welcomes other researchers and students.

-

Helsinki Stock Exchange 100 years

The seasonal exhibition at the Bank of Finland Museum presented the highlights from different decades in the 100 year history of Helsinki Stock Exchange.

-

The last Finnish markka

Finnish banknotes 1945–2002

This seasonal exhibition presented Finnish banknotes from 1945 until the euro cash changeover in 2002. The redemption of these banknotes ends on 29 February 2012, ten years after the changeover.

-

Three currencies, two centuries, one Bank of Finland

The Bank of Finland Museum's exhibition ‘Three currencies, two centuries, one Bank of Finland’ commemorated the Bank of Finland’s 200th anniversary.

-

Vitamin D! The devaluations of 1957 and 1967

The purpose of the seasonal exhibition is to explain the background to the devaluations in Finland of 1957 and 1967, how the devaluations were brought about and their effect.

-

Euro – a window to cultural identity

The euro was launched on 1 January 1999 as scriptural money. Euro in cash form was introduced for the first time in 12 EU member states on 1 January 2002. The Museum’s seventh seasonal exhibition was about Euro and it's cultural identity.

-

-

A century of bank advertising

Bank advertising as a symbol of overall economic thinking in society was the theme of the Museum’s 5th exhibition titled ‘One hundred years of bank advertising’.

-

Snellman and the Finnish markka

The fourth seasonal exhibition at the Bank of Finland Museum was titled ‘Snellman and the Finnish markka’, as 2006 celebrated 200 years since the birth of Johan Vilhelm Snellman and 125 years since his death.

-

The Bank of Finland through cartoonists' eyes

The third seasonal exhibition highlighted how the Bank of Finland has been viewed by political cartoonists from early 1950s to the present day.

-

Euro banknote design proposals

The second seasonal exhibition focused on sketch proposals for euro banknote series designs.

-

The country that paid its debts

Finland’s reputation as a reliable debtor was established in 1932, when Finland paid the instalment in full and on time to the United States on a food loan received in 1919.